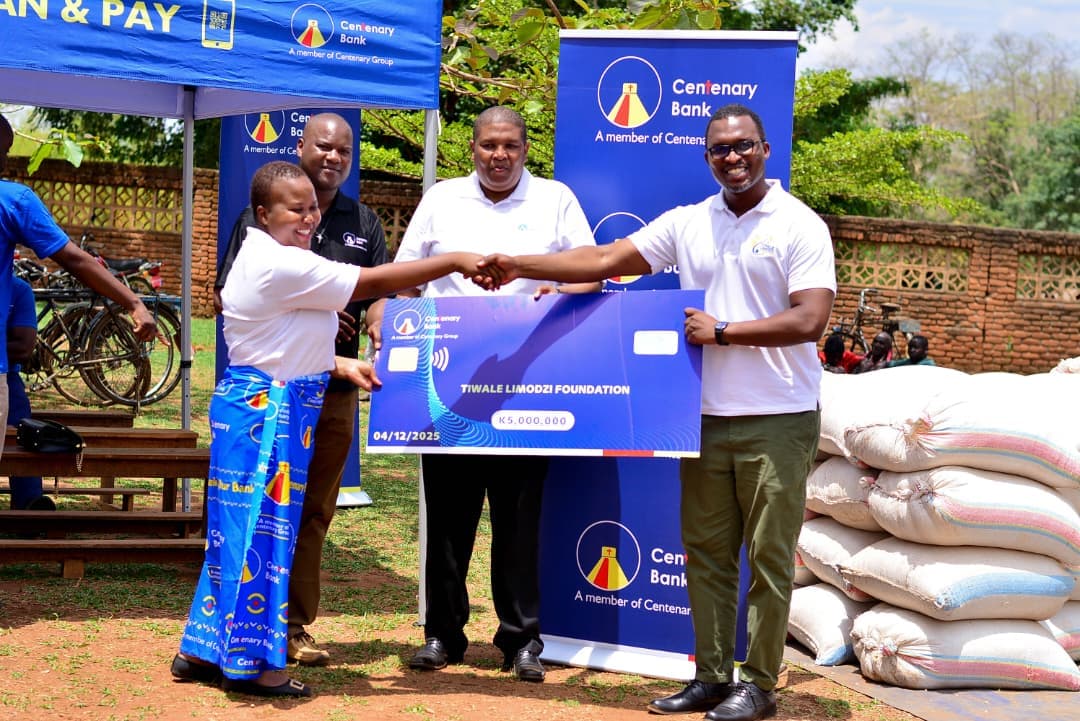

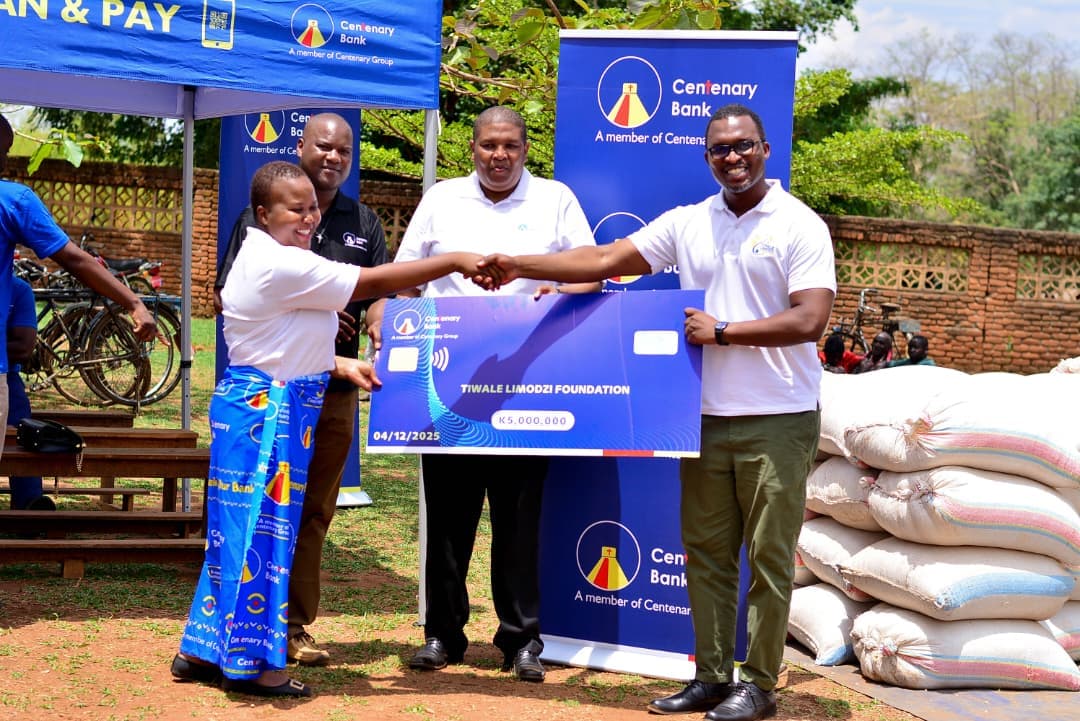

Centenary Bank Donates K5 Million to Support Hunger-Affected Families

Lilongwe, 4 December 2025 – In response to the severe hunger crisis caused by poor rainfall during the 2024–2025 farming...

Chipiliro Kameta established her business relationship with Centenary Bank Limited in 2016, having opened an ordinary saving account as a means to save the little profits she would make from her general trading business. Her first line of business was cross boarder trading, selling various items to and from South Africa.

Chipiliro Kameta established her business relationship with Centenary Bank Limited in 2016, having opened an ordinary saving account as a means to save the little profits she would make from her general trading business. Her first line of business was cross boarder trading, selling various items to and from South Africa.

As her business faced challenges due to forex availability and an influx of cheaper alternative goods from China, she decided to diversify her business in order to make ends meet. Having grown up watching her mother build houses, this became an automatic business line to venture into as this desire had been there over the years.

However, starting off with her available resources proved a challenge due to a slow down in her trading business thereby affecting her profits, which made it almost impossible to fully construct a house ready for occupation as she had other equally important responsibilities to attend to.

Her turning point was when she turned to her bank, Centenary Bank to apply for a loan that could assist her compete her housing project. To date, with the financial assistance and advise from the bank, she has managed to construct and is the proud owner of 21 houses in Chilomoni, all within a space of 7 years.

Kameta narrated that “My journey with Centenary Bank Limited has been fruitful because I did not expect in my life, against my background that I would be able to access loans from a bank and be able to repay back. I first managed to get a loan of K5, 000,000 and the effect this did to my business were astonishing. When I made this application, I wasn’t too sure of the outcome, but I must say I was impressed with how the whole process and experience went, which was exceptional.

Overtime, with the relationship that I have built with the bank and the financial advice they give me, I am able to repay all my facilities that I access on time. With this discipline and since I have made Centenary Bank my bank of choice, I am able to access loans of up to K30, 000,000 at any given time”. The introduction of Buzinesi Itukuke loans for us SMEs has even made it better for my business.

Kameta attributes her business and personal growth to Centenary Bank which has seen her uplift her financial independence enabling her to among other things easily pay school fees for her children, buying herself a nice car for personal use and better still acquire more plots to expand her property business.

Kameta urged fellow business persons especially women to be watchful on what they do with the loans they access from banks. “My fellow women should not just rush into jumping on trendy fashion and cars but should instead be firm and focused on their decisions to grow their money first and gain financial independence. It’s all about staying focused and being disciplined’, said Kameta.

In 2021, Centenary Bank introduced its “Bizinesi Itukuke” loans under the Financial Inclusion and Entrepreneurship Scaling (FInES) project to promote entrepreneurship, assist businesses that were affected by the Covid-19 pandemic and to increase access to financial services among Micro and SME Customers. This facility is offered at a concessionary interest rate of 10% per annum, subject to fulfillment of all prescribed terms and conditions.

Commenting on the strides and impacts the loans have made on customers Centenary Bank’s Head of Retail & SME Banking Mayamiko Kalizang’oma said “We are very excited by the tremendous change the “Bizinesi Itukuke” loans and other products have had on people’s lives. Whenever we hear such success and moving stories, especially from our women customers, we are challenged to do more to uplift our customers lives. As a bank, we strive towards supporting our customers be it at advisory level or financially though our credit facilities.

This is in line with our strategic intent to making people’s lives better, as these loans seek to bridge the gap that customers encounter in achieving their business success.

Centenary Bank Limited Malawi is a fully-fledged bank with branches in Blantyre, Lilongwe, Mzuzu, Zomba, Mangochi, Dzaleka, Kasungu and Madisi. Currently, it has a fully-fledged delivery channel of 14 branches, over 100 agents, and 30 ATMS across the country, offering a full range of banking products and services that include Bancassurance and Microfinance products.

Lilongwe, 4 December 2025 – In response to the severe hunger crisis caused by poor rainfall during the 2024–2025 farming...

CENTENARY BANK MALAWI Civil Servants General Terms and Conditions 1. Declaration and Authorization by Applicant I, the ...

At Centenary Bank, we believe banking should do more than just hold your money, it should empower you, protect you, and ...